If you are foreign, self-employed, and your net earnings (income minus expenses) are more than $400, you need to file and pay self-employment tax. Paying in is necessary to receive credit toward Social Security benefits.

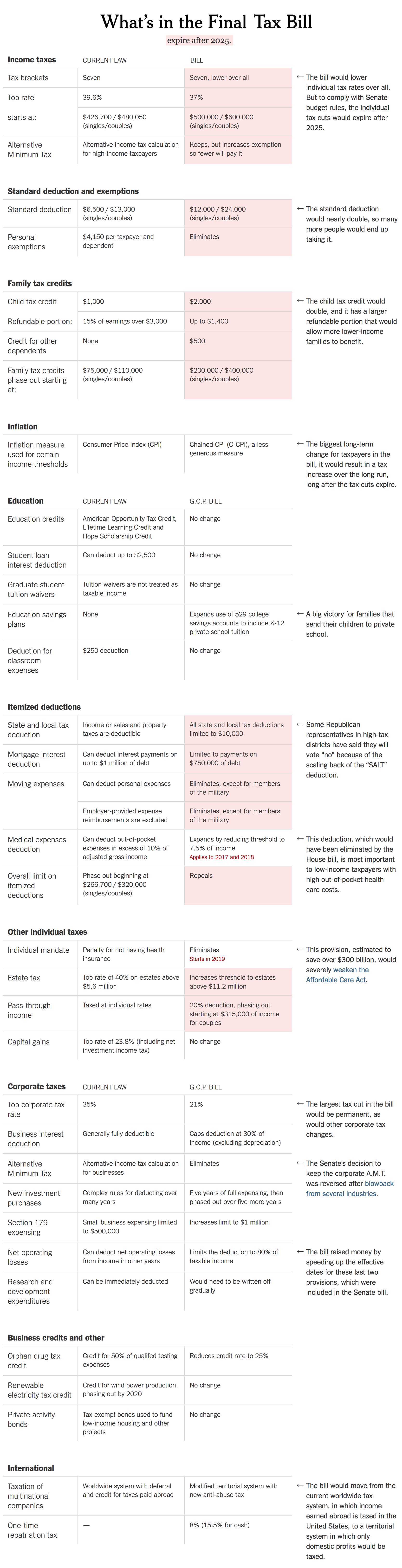

If you are a U.S. citizen or a resident alien of the United States and you live outside the U.S., you are taxed on your worldwide income. However, you may qualify to exclude from your income an amount of your foreign earnings that is adjusted annually for inflation ($91,500 for 2010, $92,900 for 2011, $95,100 for 2012, and $97,600 for 2013). In addition, you can exclude or deduct certain foreign housing amounts.

A qualifying […]